Options Trading Grade: B

Overview:

As one would expect from a broker with option in its name, trading options at eOption is a good experience. Opening new positions from the order entry panel is simple yet effective. Closing out existing positions from the account positions menu is also well implemented. Open orders can be canceled but they cannot be modified - a minor inconvenience. The large number of order types will satisfy the needs of all but the most advanced options traders. Trade confirmations display the trade time down to the second.

Option Order Types:

- Buy-write (stock + one option leg) - An order to simultaneously purchase (sell) a stock and sell (purchase) a call option of the same underlying.

- Spread (two option legs) - Buy/sell any combination of puts/calls

- Combo (two option legs) - Either (1) buy a put option and sell a call option or (2) sell a call and buy a put

- Straddle (two option legs) - Buy/sell a put and call with matching strikes and expiration

- Strangle (two option legs) - Buy/sell a put and call with matching strikes and varying expiration

- Butterfly (four option legs) - Buy an option with one strike price, buy an option with a second strike price, and sell two options with a third strike price that is midway between the prices of the first two options

- Condor (four option legs) - Buy two options and sell two options. All options are either puts or calls.

- Iron Butterfly (four option legs) - Differs from the butterfly spread because it uses both calls and puts, as opposed to all calls or all puts.

- Iron Condor (four option legs) - Buy/sell two puts and buy/sell two calls

- Rollout (one option leg) - Cover one option position and initiate a new position with a later expiration

Details:

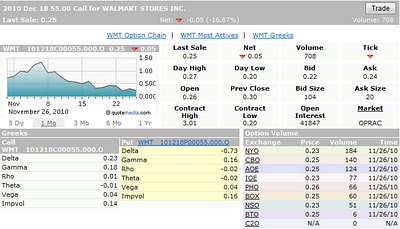

To trade options at eOption, select Trading and then Options from the top menu. This will load the options order entry panel. We set the action to buy, the number of contracts to 1 and entered the underlying stock symbol, WMT (Walmart). We then clicked on the options chain link, which loaded a separate window showing the available contracts for Walmart. Clicking on a particular contract loads a detailed contract page. Here is the page we brought up for the December $55 Call which shows useful information such as the volume, open interest, bid/ask and even an options price chart. It would be nice if the price chart could be enlarged:

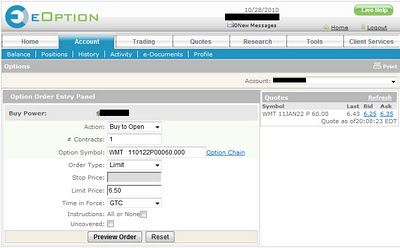

We decided on a different contract so we clicked on the trade button within the options chain menu. This brought us back to the order entry panel and populated the contract that we selected. We changed the order type to limit, set the limit price to $6.50, changed the time in force to GTC (good until canceled) and clicked on the Preview Order button:

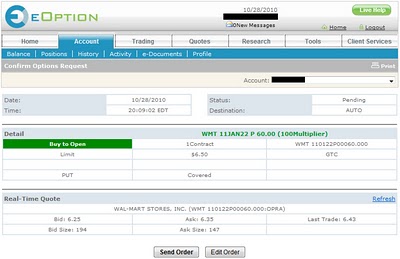

This loaded the preview order menu. Everything looked correct so we select to submit our order:

Once our order was submitted, we were given an order confirmation number. We quickly clicked on the Check Order Status button which showed us the now open order. From this menu, orders can be canceled, which updates the order status immediately. The ability to modify open orders is something that many other brokers offer but this feature is missing at eOption.

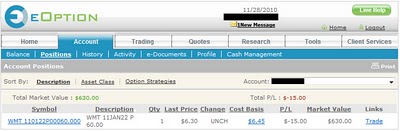

Our order eventually executed and once it did, it populated the our new position in the Account Positions menu. After suffering a small loss, we decided to close out our position so from within this menu we clicked on the Trade link:

This brought up the options order entry panel with the action sell to close, the number of contracts that we held at the time and the option symbol for our position.

Related Articles:

eOption Review

eOption Stock Trading

eOption Charts

eOption Research Tools